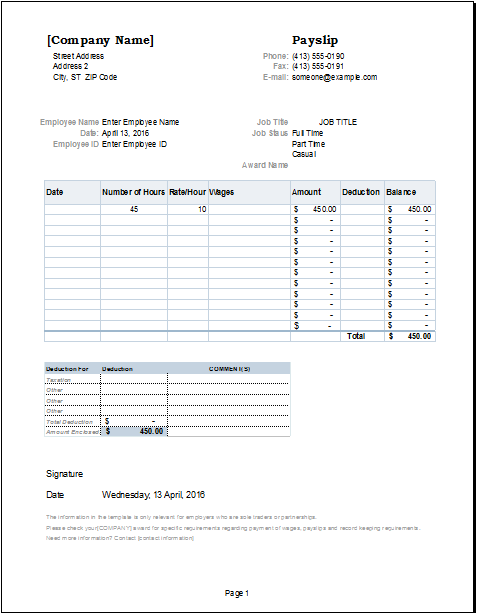

Others have an integrated pay slip creation system that combines payroll spreadsheet, net employee pay, and tax withholding estimates. Most employers go to paycheck calculator for calculations on tax withholding estimates among other calculations. One of these regulations includes calculating the right taxes. Just like the contract for employment, there are many laws and regulations involved with creating the right payslip. Superannuation / Pension: Superannuation is a mandatory system where a person's employer contributes money to a super fund on their behalf to be financially supported after they leave the job.South African payslip template doc is an important modelling doc that allows you to create the perfect payslip for your employees.Income tax: Individual and company income are subject to income tax, which is a kind of tax imposed by governments on the revenue produced by companies and people within their jurisdiction.In the same vein, the employer equally contributes to the plan on their employees' behalf, as explained above. EPF: The Employee Provident Fund is a retirement savings plan into which workers of a company make monthly contributions equal to a modest percentage of their basic salary.Essentially, it is a kind of risk management that is mainly used to protect against the possibility of a future or unknown loss. Insurance: An insurance policy is a method of protecting yourself against financial loss.As the name implies, Leave Travel Allowance refers to an employee's allowance while travelling with their family or by themselves. It is a tax break provided by a company to its workers. LTA: Leave Travel Allowance is one of the most effective tax-saving measures available that can benefit Employees.HRA: House Rent Allowance is a compensation component given by employers to workers to cover the cost of renting a property for residential reasons.It can include tasks beyond their regular working hours and beyond the agreed-upon time frame.

0 kommentar(er)

0 kommentar(er)